The Greatest Guide To Real Estate Loans - Heritage Bank of Nevada

Basic FHA Loan Requirements for New Jersey Borrowers - NJ Lenders Corp.

Greater Nevada Mortgage - LinkedIn

Some Known Factual Statements About Nevada FHA Loans - Nevada VA Loans - Nevada

FHA loans are for main residences only and if your goal is to acquire a financial investment home, you can not utilize FHA insured funding for that purchase. However, if you are presently residing in a home that is financed with an FHA loan, you can transfer to a new house and keep the present home as a financial investment.

See which program is ideal for you!

What is an FHA Loan? The primary goal of the Federal Housing Administration (FHA) is to improve the real estate market and protect lenders in case a borrower was to default on their mortgage. Reference has actually turned into one of the largest insurance provider of mortgages in the United States. Superior Home Loan Loaning LLC is happy to offer excellent rates and versatile funding choices on Las Vegas, Henderson, North Las Vegas and the whole state of Nevada.

Little Known Facts About Nevada Mortgage Calculator - SmartAsset.

If you have actually had difficulty find a conventional loan that works for you, a FHA may be ideal for you. What can a FHA Loan be used for? A Las Vegas FHA Loan can be used for a number of different purposes including but not restricted to: purchasing a brand-new home, special renovation tasks, refinancing a current home mortgage, and even reverse mortgages.

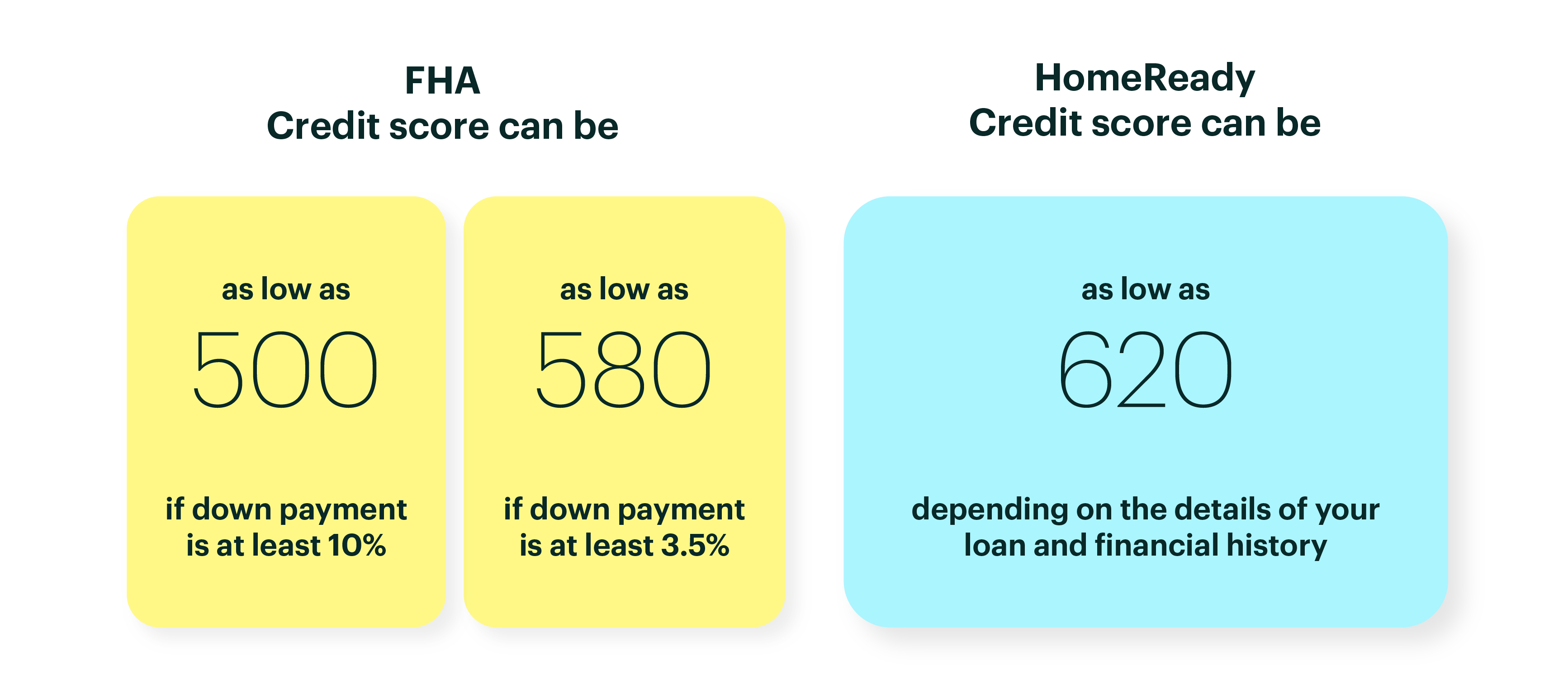

Streamline re-finance loans are likewise labile to decrease interest on existing loans. FHA Credit Requirements FHA Loans offer relaxed credit requirements and lower down payment choices making them much easier to certify for and incredibly popular to those in the state of Nevada. To certify for an FHA Loan in Las Vegas they need a deposit of 3.

If a customers does not having enough savings, member of the family can likewise present the down payment. FHA Loans are a popular option to first time house purchasers in Las Vegas, North Las Vegas, Henderson, and the entire state of Nevada. Nevada FHA Loan Requirements Low Deposit: The 3. 5% deposit is usually less that for a similar traditional loan Less strict qualifying requirements: for example- FHA will allow reestablishment of credit within two years after a discharge of insolvency; when any judgments have actually been totally paid, any tax liens have been repaid, or a repayment plan has actually been established by the Internal Revenue Service, and within 3 years after a foreclosure has actually been fixed The property must be owner inhabited: The FHA used to guarantee investors homes but they have actually essentially eliminated all such programs.